DGTLPROD

Is Your Money Disappearing?

Monthly Budget Spreadsheet V2.1

Don't Let Poor Budgeting Ruin Your Life. Take control of your finances today! Get The Ultimate Spreadsheet to Prevent Financial Disaster.

I’ve never felt more in control of my money!

Ankita Bhatnagar

3 Tabs to have your finances sorted!

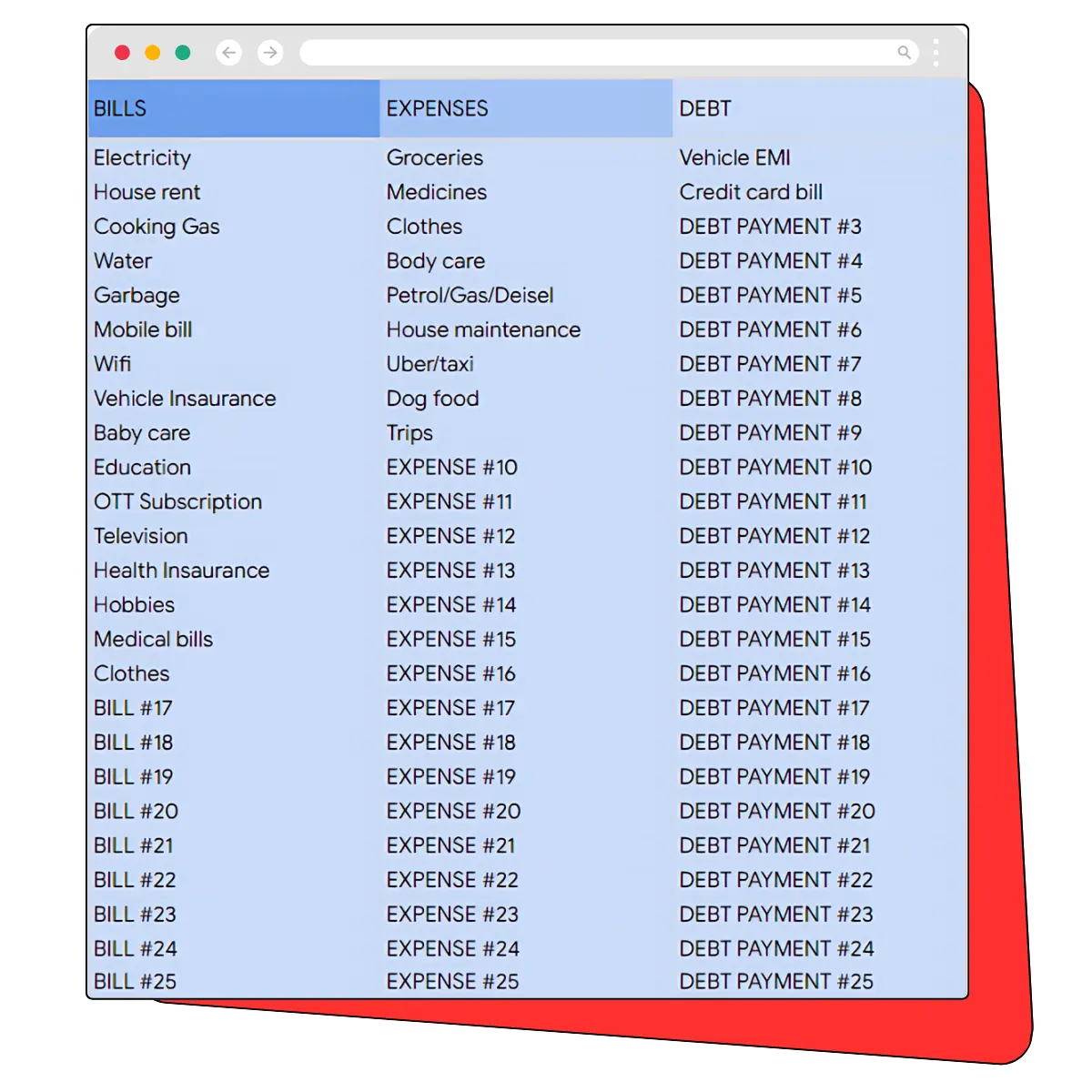

Categories Tab,

The Categories Tab is designed to streamline your budgeting process by organizing your financial data into three main sections: Bills, Categories, and Expenses. This structure ensures that every aspect of your spending is covered and easily accessible. Key features include:

Bills Section:

This section helps you keep track of all your recurring bills. Pre-filled with typical bills such as Rent, Renter's/Home Insurance, Internet.

Expenses Section:

Manage and categorize your everyday expenses with ease. Typical expenses listed include Groceries, Restaurants, Clothes, and Gas/Fuel. This categorization helps you understand and control your spending habits.

Debt Section:

Stay on top of your debt payments with this section. This helps ensuring you don't miss any critical payments.

Fully Editable and Customizable:

Our spreadsheet is designed to be flexible. You can add as many categories as you need, whether it's for additional bills, expenses, or debts. Every field is completely editable.

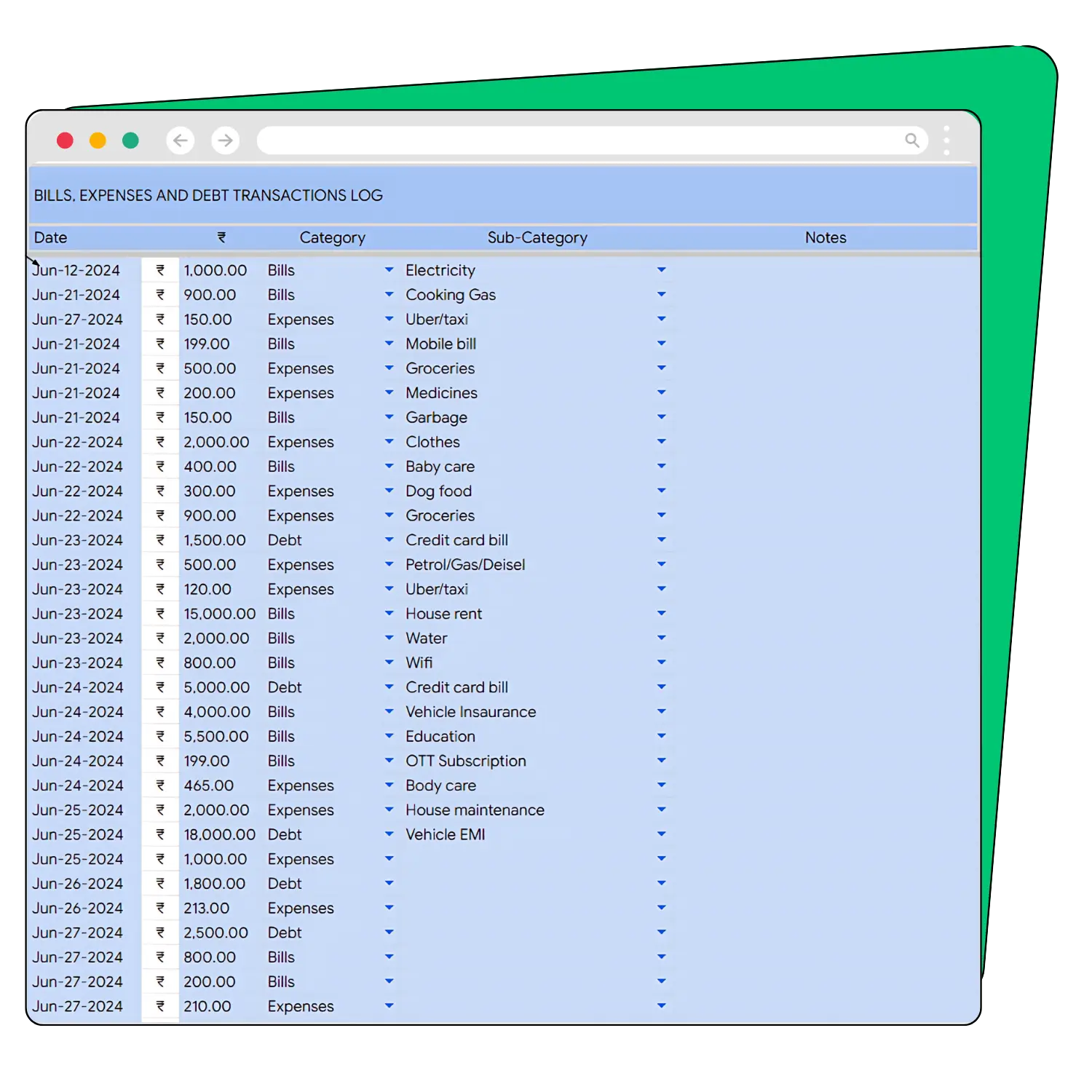

Log Tab,

The Log Tab is where you keep a detailed record of your actual bills, expenses, and debt transactions as you spend money. This feature is designed to make tracking your financial activities straightforward and efficient. Here’s how it works:

Easy Date Entry:

Quickly insert the date of each transaction with a single click, formatted as MM/DD/YYYY. This saves you time and ensures consistency in your records.

Add Value:

Enter the amount of each transaction effortlessly. Whether it's a bill payment, an expense, or a debt payment, simply input the value.

Category and Sub-Category:

Assign each transaction to a relevant category and sub-category. This helps in organizing your spending and provides a detailed breakdown of where your money is going.

Fully Editable and Customizable:

Our spreadsheet is designed to be flexible. You can add as many categories as you need, whether it's for additional bills, expenses, or debts. Every field is completely editable.

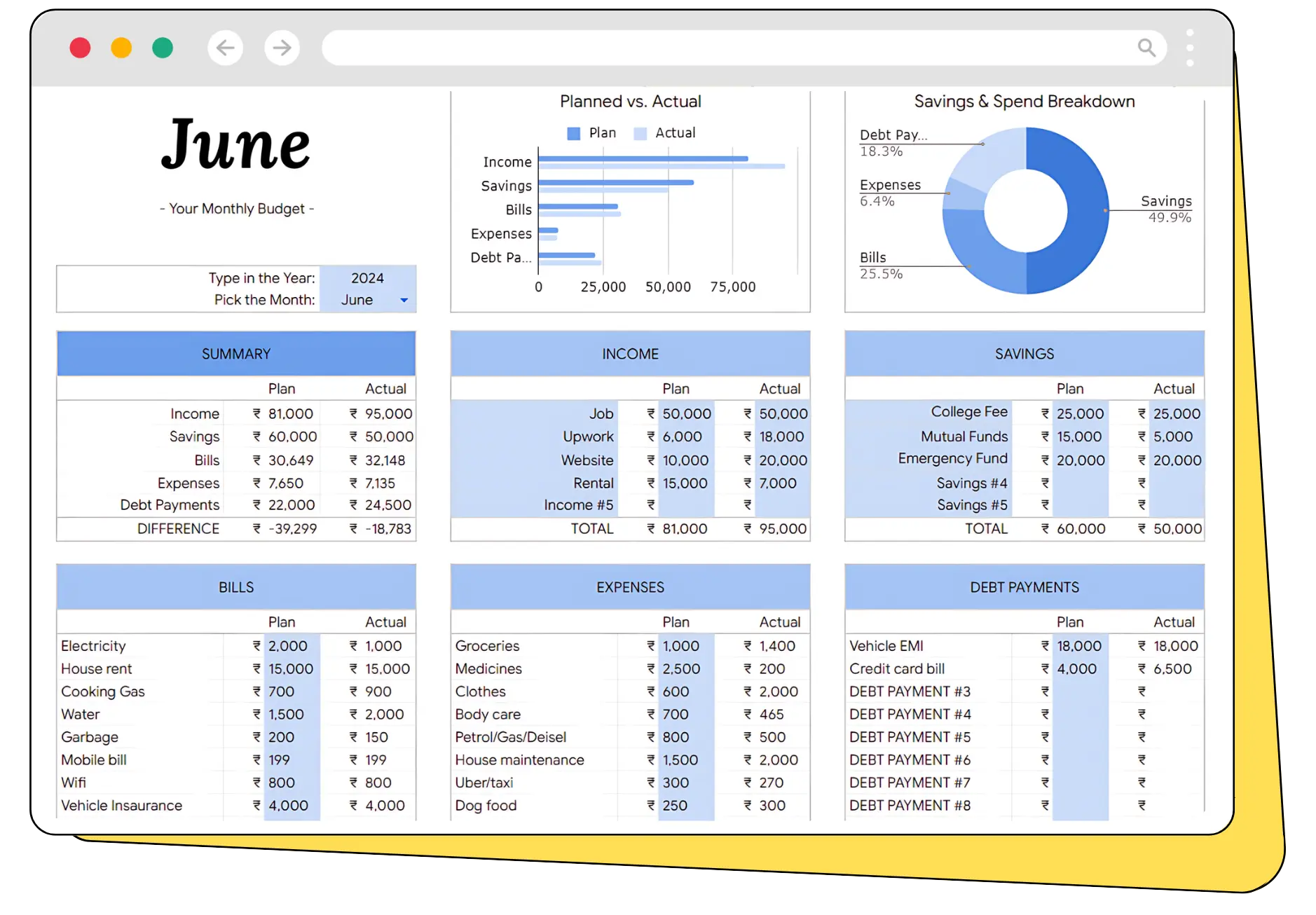

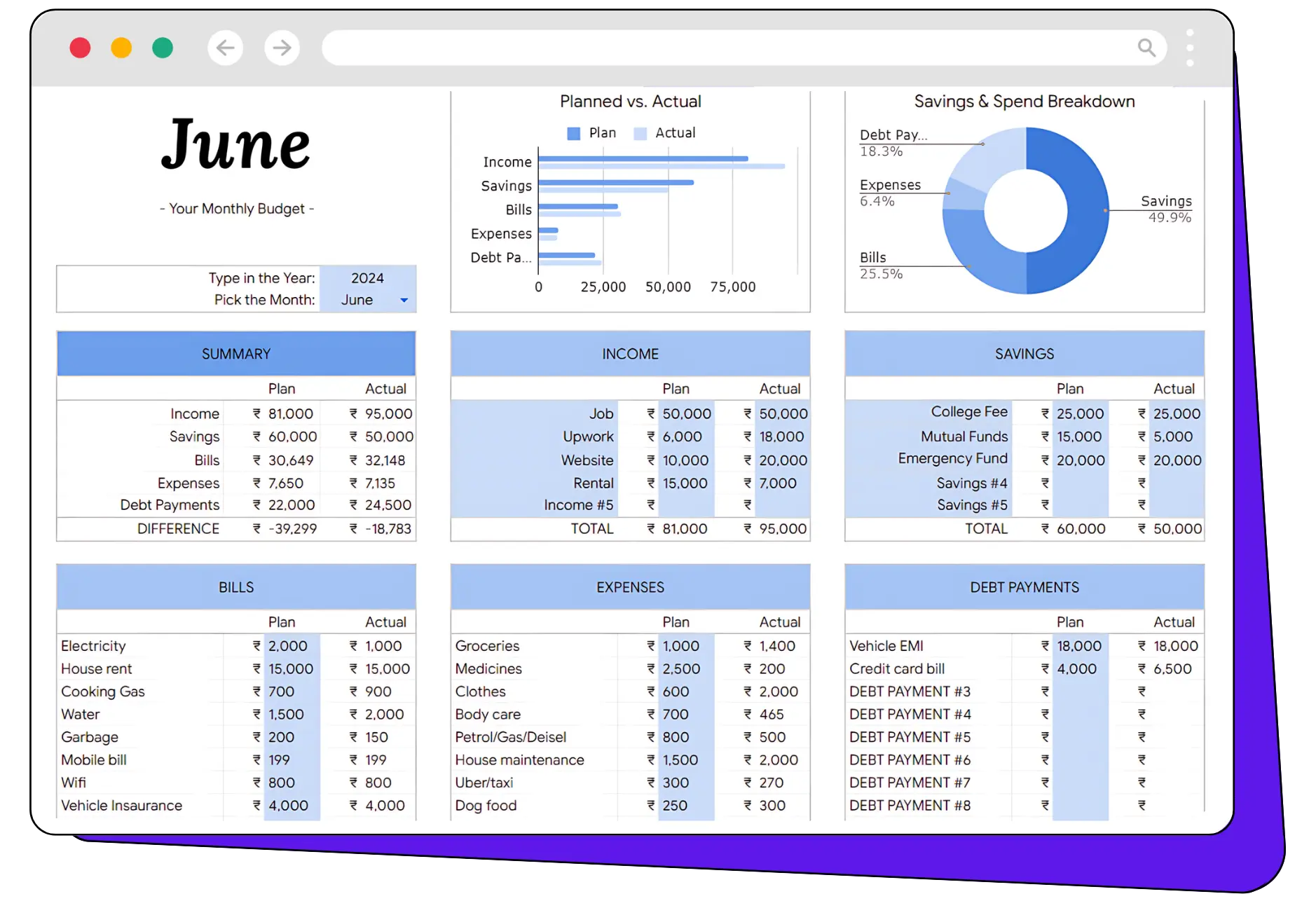

The Dashboard itself,

The Dashboard Tab provides a complete overview of every single rupee spent in a particular month, offering a clear and detailed picture of your financial health. Here’s what you can expect:

Comprehensive Financial Overview:

Get a full breakdown of your planned vs. actual spending, savings, income, bills, expenditures, and debt payments. This overview helps you understand your financial status at a glance.

Editable Columns:

The columns in blue are fully editable, allowing you to adjust your budget as needed. All other columns are automatically populated based on your inputs from the Log and Categories tabs, ensuring accuracy and consistency.

Month and Year Selection:

At the top of the dashboard, you can choose the month and year to display the relevant financial data. This feature allows you to track your finances month-by-month.

Notes Section:

Add your own notes in the lower section of the dashboard. This is useful for recording observations, reminders, or any other important information related to your budget.

Easy Duplication for Future Months:

Once you finalize your budget for one month, you can easily copy this tab for the next month. Simply right-click on the tab and select "Duplicate." This feature saves you time and ensures continuity in your budgeting process.

Month Dropdown Selection:

Remember to select the correct month from the dropdown in row 10. This ensures that all your data is accurately reflected for the chosen month.

All the data entered in the Categories Tab is automatically reflected on the main dashboard, providing a seamless and integrated budgeting experience. This linkage ensures that your financial overview is always up-to-date without the need for manual updates.

Who is this for?

Individuals seeking to manage their personal finances effectively.

Families wanting to track household expenses and savings goals.

Students needing to budget their allowances and expenses.

Freelancers and Entrepreneurs aiming to keep their business and personal finances in check.

Easiest 4-Step Process,

1

Download & Setup:

Instantly download the spreadsheet upon purchase. Open it in Excel or Google Sheets.

2

Input Your Data:

Enter your income sources and expenses. Customize categories as needed.

3

Track Progress:

Regularly update the spreadsheet to keep track of your financial journey.

4

Analyze & Adjust:

Use the insights gained to adjust your spending, increase savings, and achieve your financial goals.

99% of our customers say that our spreadsheet has helped them manage their finances effectively!

This spreadsheet has been a game-changer for my finances. The design is lovely, and it’s so easy to use. I’ve never felt more in control of my money!

Anurag Kashyap

As a freelancer, I struggled to keep track of my income and expenses. This spreadsheet has made it so simple. Highly recommend!

Divya Rajput

Our family budget is now organized and clear. We can see where we need to cut back and where we can save more. It’s perfect!

Anaya Khan

The Categories Tab is so detailed and well-organized. It has made managing my bills and expenses a breeze!

Mohit M.

I love how customizable this spreadsheet is. I can add as many categories as I need and it fits my unique financial situation perfectly.

Kumar Gaurav

Benefits that You'll Love

Reduce Financial Stress: Gain clarity and control over your finances.

Make Informed Decisions: Understand your financial situation to make better choices.

Achieve Your Goals: Stay on track with your savings and financial targets.

Beautiful and Functional: Enjoy a beautifully designed tool that you’ll love using every day.

Monthly Budget Spreadsheet V2.1

Don’t let another month go by without taking control of your finances. Order today and begin your journey to financial freedom with style and simplicity!

Only 16 Copies Left*

Your Satisfaction is our No.1 Priority!

We are confident that our Monthly Budget Planner will help you manage your finances effectively and achieve your budgeting goals. If for any reason you are not completely satisfied with your experience or the results, please reach out to our customer support team, and we will work with you to ensure your needs are fully addressed and that you gain the full benefits of using our planner. Your satisfaction is our top priority.

Got Questions? We got Answers!!!

Getting started is easy! Simply download the spreadsheet, open it in your preferred spreadsheet software, and begin by filling out the Categories Tab with your bills, expenses, and debt payments.

Absolutely! The spreadsheet is fully editable and customizable. You can add, remove, or modify categories to suit your unique financial situation.

Use the Log Tab to record your actual bills, expenses, and debt transactions as you spend money. Enter the date, value, category, and sub-category of each transaction, and the spreadsheet will automatically update the main dashboard.

Yes! Once you finalize your budget for one month, you can easily copy the Dashboard Tab for the next month by right-clicking on the tab and selecting “Duplicate.” Don’t forget to select the correct month from the dropdown in row 10.

No problem! The editable blue columns on the Dashboard Tab allow you to make adjustments at any time. All other columns will update automatically based on your new inputs.

Yes, you can set realistic savings goals and track your progress using the Savings and Goals section of the spreadsheet. Watch your savings grow month by month and stay motivated!

The Bonus Tab helps you prioritize your spending and identify areas where you can cut costs. The summary section on the left provides an automatic overview of your potential savings, helping you boost your financial health.

The Monthly Budget Spreadsheet is compatible with popular spreadsheet software like Microsoft Excel, Google Sheets, and Apple Numbers.

While the spreadsheet is designed for use on desktop or laptop computers, it can also be accessed and edited on mobile devices using compatible spreadsheet apps like Google Sheets or Microsoft Excel.

Your financial information is stored locally on your device, ensuring that you have complete control over your data’s security and privacy. Always make sure to back up your data regularly.